What You’ll Find This Week

HELLO {{ FNAME | INNOVATOR }}!

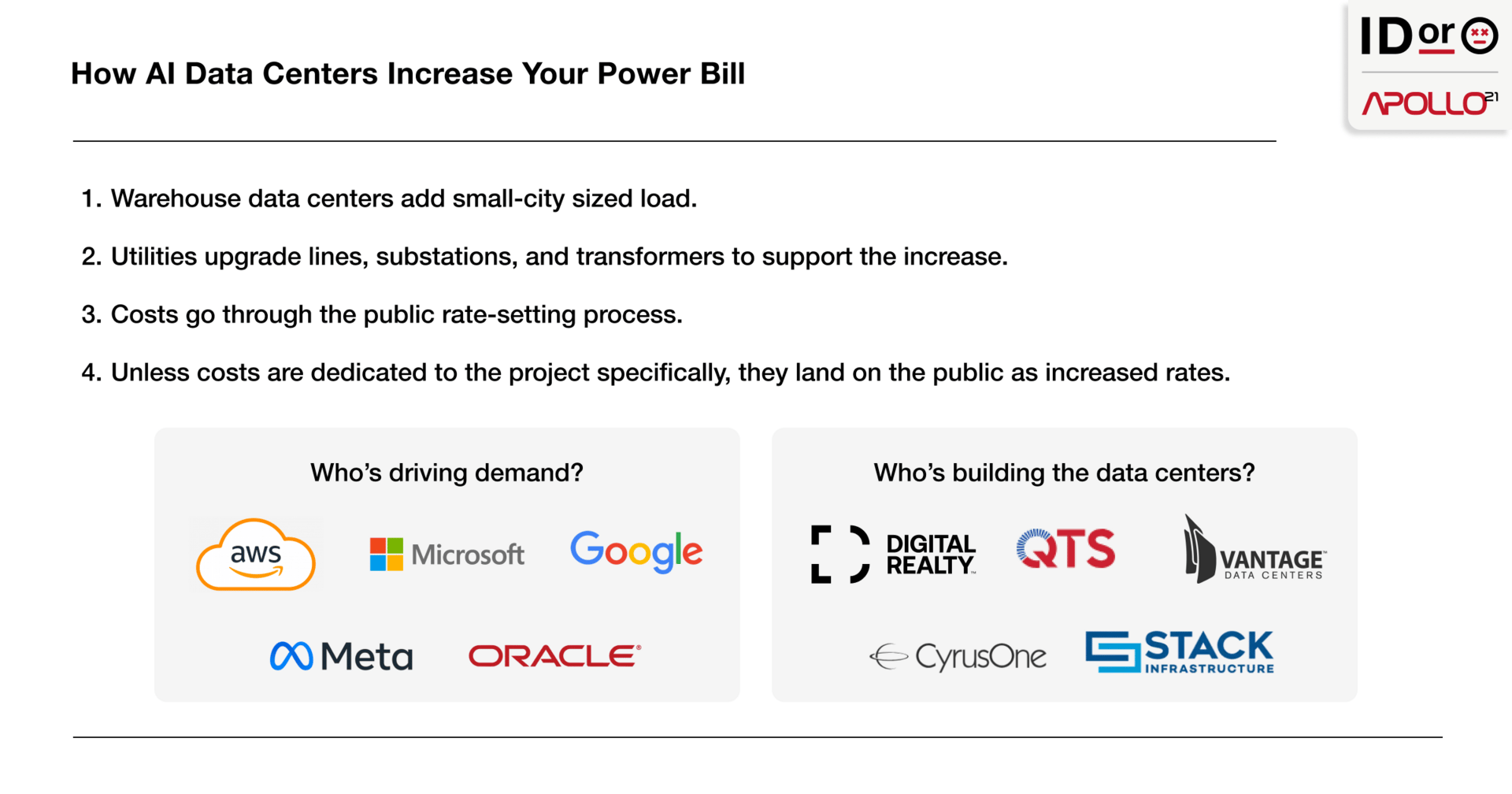

Last week I shared some insights on the impact of our AI-driven future on everyday needs like our power supply — and how those changing needs will impact the everyman. (Hint, energy costs are rising. 📈)

This week, I’m taking a look at how legislation might combat those rising costs by ensuring that the data center operators pay their share of the upgrades and usage they’re demanding of the grid. The state of Virginia is leading the charge with recent changes and a new rate class specifically targeted at hyperscalers and data center operators.

This week’s case study offers a closer look at what might prove to be a precedent-setting change forcing the companies who demand power to pay for its delivery.

Here’s what you’ll find:

This Week’s Case Study: Virginia Leads the Charge Against Hyperscalers

Share This: How AI Data Centers Increase Your Power Bill

Don’t Miss Our Latest Podcast

Case Study

CASE STUDY

Virginia Leads the Charge Against Hyperscalers

Virginia is home to more giant data centers than anywhere else in the world. That means it sits squarely at the intersection of compute power and grid stress. If you read Sunday’s piece on AI turning power access into a real bottleneck, Virginia is what it looks like when the theory hits your utility bill.

What Happened

Virginia’s State Corporation Commission approved Dominion Energy’s biennial review order with two headlines that matter.

First: rates went up, but not as much as Dominion asked for. The SCC approved revenue increases of $565.7M in 2026 and $209.9M in 2027, which it said translates to about +$11.24/month for a typical residential customer in 2026 and +$2.36/month in 2027. Dominion also got a slightly higher authorized return on equity of 9.8%. (Inside Climate News frames the typical bill impact at roughly $16/month.)

Second: the SCC created a new large-load rate class that aims directly at data center cost shifting.

GS-5: A New Rate Class For Data Center-Scale Load

Starting Jan. 1, 2027, the SCC’s new GS-5 rate class covers customers with 25 MW+ demand and a 75%+ load factor, which captures the steady, always-on shape of data center load.

The core change is simple: large-load customers have to pay for more of what they ask the grid to build.

The SCC requires certain large customers to commit to long-term contracts and minimum demand charges, including paying at least 85% of contracted transmission and distribution demand and 60% of generation demand. That’s designed to reduce the gap between what a data center contracts for and what it actually uses while it ramps up.

Inside Climate News gives the clean example: a data center could sign for 100 MW, use 20 MW during buildout, and still trigger upgrades built for 100 MW. The new structure pushes more of that cost back toward the buyer of the capacity.

Setting the Precedent

Virginia didn’t take action by writing a policy essay about AI. They’ve made real accountability changes. GS-5 is the state telling data centers, “you don’t get to reserve 100 MW, trigger upgrades built for 100 MW, then pay like you only wanted 20.”

This single move potentially does more to shape the future of AI than any model release will. It forces the people chasing small-city power to carry more of the cost of the grid they’re reshaping.

And once one regulator draws that line, others can copy/paste it.

3 Must Reads

Share This