What You’ll Find This Week

HELLO {{ FNAME | INNOVATOR }}!

If you’ve ever worked at a startup, you know that options are part of the promise. You toil away helping someone bring their idea to life, and in exchange, you get stock options. But keeping your options open isn’t just for the startup employees of the world; major companies also make use of options for all sorts of outcomes.

This week’s guest post comes from Drew Jackson, author of the Brainwaves newsletter. In this piece, Drew gives us a crash course in Real Options and how companies leverage them to bend the world to their needs.

Here’s what you’ll find:

This Week’s Guest Post: Limited Risk, Unlimited Upside Through Options

Case Study: Amazon Creates Optionality With Initial Investments

Share This: Real Options Value: A 3-Point Flexibility Check

Don’t Miss Our Latest Podcast

This week, we’re featuring a guest post by Drew Jackson, the creator behind Brainwaves. In this edition, Drew offers an in-depth analysis of real options, showcasing how corporations can achieve large payoffs with limited risk while highlighting why business leaders shouldn’t view market volatility or technological uncertainty as threats to be avoided.

Today, experts argue that optionality is the only way to outperform the average over the long run. We’ll look at how cultivating optionality solves a large portion of the market’s uncertainty and unpredictability, and what business leaders can learn from models like Corporate Venture Capital to create asymmetric payoffs.

Advertisement

Go from AI overwhelmed to AI savvy professional

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

This Week’s Article

Limited Risk, Unlimited Upside Through Options

You might already be familiar with the idea of options from a startup or investment perspective. When a company issues stock options to its employees, it’s not giving them stock; it’s giving them the right, but not the obligation, to buy stock at a predetermined price in the future.

This creates a powerful, asymmetric payoff: the employee pays very little for the option, and if the company succeeds, they realize a huge gain. This same fundamental concept—the power of gaining a future right without an immediate obligation—is at the heart of what business leaders can use to navigate the constant uncertainty and unpredictability of the modern market.

Options: They’re Not Just for Startups

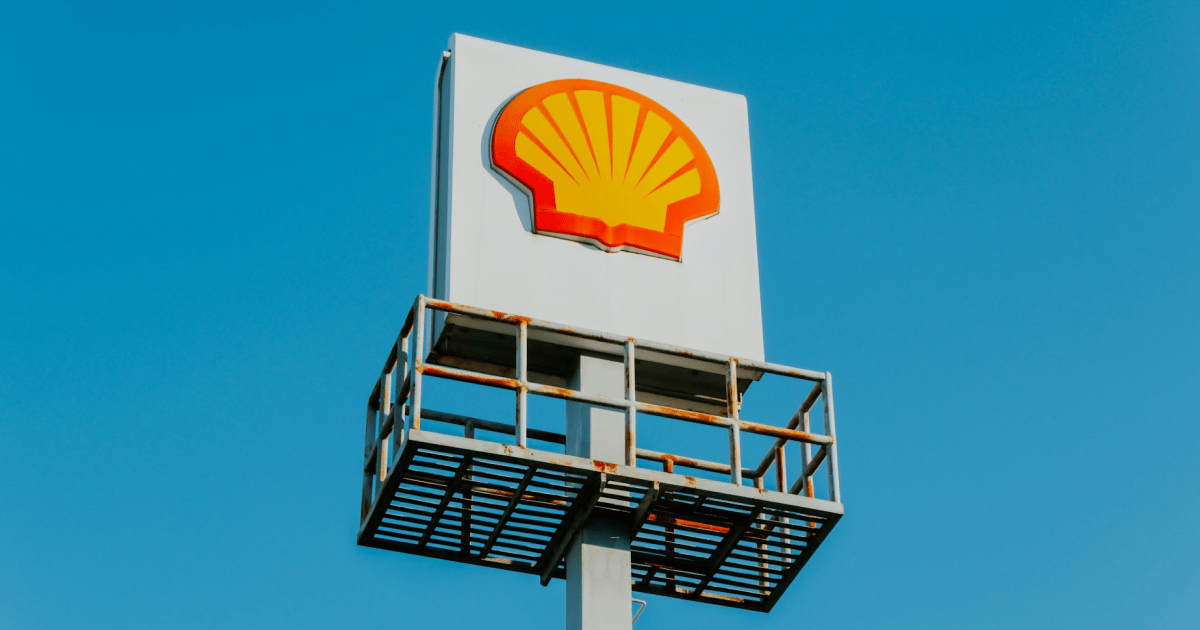

Options apply to businesses of all shapes and sizes. In July 2025, after applying over a year previously, Shell was granted environmental authorization to drill up to five deep-water wells off South Africa’s west coast.

Oil companies have been pursuing drilling opportunities in the region for years, attempting to tap into the area where the Orange Basin extends southwards into the country’s waters. Successful nearby attempts in Namibia spurred attempts to recreate the model in South Africa.

While the value of the payout is highly relevant to Shell (billions of dollars in profits from oil sales), the true value is the real option (the opportunity to drill) they possess.

Shell, among many other major oil and gas companies, seeks to pursue multi-year exploration licenses on offshore fields or deep-sea blocks. These licenses provide them the exclusive right to drill and develop in that area.

There are hundreds of these licenses granted every year across the globe, however some are never acted on. Why?

The Science of Real Options

Options are most often talked about in a financial context, where they give the holder the option, but not the obligation to buy or sell at a certain price.

Similarly, there exists a real option for companies, which provides the right, but not the obligation, for a company’s management to take a specific business initiative.

The scenario described above details Shell’s option to defer investment, also known as a timing option, which is the option to wait and gather more information before committing to an irreversible investment.

For oil companies, exclusive licenses enable them to wait to develop the area until they have confirmed the presence of oil and ensured the net present value of the investment would be positive.

If the current price of oil is $60 per barrel and Shell believes it has a good chance of rising to $80 in the next two years, the optimal decision for their South African investment is to wait. By deferring the investment, they preserve the option value. If the prices jump, they exercise the option (invest and develop). If prices crash, they let the option expire, saving the huge cost of a development that would have lost money.

Besides timing options, the most popular real options are growth options and exit options.

Growth options provide the option to increase the scale of a project or make follow-on investments if initial results are favorable. If a pharmaceutical company achieves a successful early-stage R&D project, it can exercise the option to invest further, funding the next stage of testing. If the early-stage project fails, the company can easily abandon it, without having invested in the next stage prematurely.

Exit options provide the option to stop a project and sell the assets for their market value if market conditions or performance are worse than expected. If a manufacturing company builds a new plant with general-purpose, reusable equipment and the product fails, it can exercise the option to abandon by selling the equipment and/or the facility, limiting its losses.

Optionality Is The Solution to Uncertainty + Unpredictability

Businesses are vulnerable to uncertainty and unpredictability throughout every stage of the innovation and disruption cycle.

How should business leaders address the constant uncertainty and unpredictability they encounter?

Cultivating optionality is the solution.

Nassim Taleb writes, “If you start from the premise that we are living in an uncertain world, then optionality is the only way to outperform the average over the long run.”

Taleb’s Antifragile framework is centered on the concept of optionality. He believes an antifragile system, in his opinion the “best” modern system, is one that benefits, rather than is harmed, from randomness, volatility, and stress.

Optionality creates antifragility. It represents a convex payoff function, which means the potential upside from the opportunity (Shell choosing to drill and make billions) is far greater than the limited downside (Shell losing a little money on the rights to the option).

The business strategy of having the right but not the obligation to expand, wait, or abandon a project is a textbook example of a convex payoff: Your losses are capped at the cost of the initial investment, but you retain the option of potentially unlimited gains.

In essence, optionality proactively addresses uncertainty and unpredictability: it allows you to discard the bad outcomes while selecting and amplifying the good ones. It ensures that volatility—the very thing that causes trouble for fragile systems—actually becomes a source of benefit for those with options.

Corporate Venture Capital: A Cheat Code?

Many large corporations have a proprietary generator of real options: corporate venture capital funds (CVC).

In 2009, Google unsuccessfully tried to gain a foothold in the smart home market, launching the PowerMeter service, then subsequently shutting it down in 2011. In 2011, still interested in the sector, co-founder Sergey Brin met Nest’s team, viewing a proprietary prototype of their thermostat device.

Later that year, Google Ventures joined others in a $55M Series B funding raise for Nest.

Only 3 years later, Google announced its $3.2B acquisition of Nest.

The initial investment provided Google the opportunity to observe Nest’s technology, team, and market fit, complete with access to information that competitors lacked, significantly reducing the uncertainty of a future acquisition.

Instead of committing massive R&D resources internally (a large, irreversible investment with high risk), corporations can pay a small premium (the CVC investment) to gain a flexible path to acquisition in the future.

Real Options Value: A 3-Point Flexibility Check

For an investment to maximize value under uncertainty, it must intentionally prioritize flexibility. If you can answer YES to these questions, your project is likely leveraging the value of Real Options:

Is there an early, small investment that creates the right to a larger investment later?

Does the project design allow for a clean “off-ramp” where you can recover a significant portion if market conditions worsen?

Are you deliberately delaying the final capital commitment until key uncertainties are resolved?

The Lesson for Business Leaders

Small investments today can yield large benefits in the future.

Managerial flexibility is an asset that must be factored into project valuation. Standard methodologies undervalue projects with high uncertainty and flexibility, causing companies to reject potentially valuable ventures.

Real options give the company an asymmetric payoff structure: limited losses (the initial investment) and potentially unlimited gains (the growth opportunity).

Leaders should stop viewing market volatility or technological uncertainty purely as a threat to be avoided and start viewing them as a potential source of strategic advantage to be exploited through staged, flexible investments.

Case Study

CASE STUDY

Amazon Creates Optionality With Initial Investments

In the early days of operating Amazon, executives experienced how hard and expensive it was to provision and manage backend technological infrastructure.

Deciding in-house was the best investment, they launched Amazon Web Services (AWS) in 2006.

After significant investments, Amazon built a world-class IT infrastructure to support its e-commerce site.

This created the option to sell any excess capacity as a service to other companies, capturing the upside payoff to the initial investment (exercising the option).

Over the last two decades, this option continued to snowball, growing to over $17B in revenue in 2025 (around 17% of Amazon’s total revenue).

Share This

:max_bytes(150000):strip_icc()/Realoption_final-b85b4533830d40118566a3c352b04ab5.png)