What You’ll Find This Week

HELLO {{ FNAME | INNOVATOR }}!

Every founder dreams of getting acquired. Exits are worn like badges of honor. Success validates the long, sleepless nights and the years-long grind that many of us go through. But there’s no guarantee. And, if you are lucky enough to entertain acquisition, there are hurdles along the way.

This week’s guest post comes from Alex Shartsis, founder of Skyp, the AI-powered outbound platform for startups. Alex also advises founders on GTM and M&A at Silverwood, where he pens the Seed to Sequoia newsletter. In this piece, he lays out the unvarnished truth on what it really takes to get acquired…and why many founders may be playing catch-up.

Here’s what you’ll find:

This Week’s Article: The Realities of Getting Acquired

Share This: Your Playbook for Exit Readiness

Don’t Miss Our Latest Podcast

For this post, we turned to Alex Shartsis, an early-stage GTM leader turned founder. Alex ran corp dev for Opendoor, and has helped many founders, himself included, source and negotiate exits. Today, when not working with founders, he writes the Seed to Sequoia newsletter on GTM, fundraising, and acquisitions, and he’s building Skyp, an AI-powered app for sending email microcampaigns.

Alex has seen acquisitions from every angle: operator, founder, & advisor, and he’s written extensively about it. Below is his unvarnished take on what founders really need to know about getting acquired.

This Week’s Article

The Realities of Getting Acquired

The Myths That Trip Founders Up

When I talk to founders about exits, I often see two myths that do real damage:

“If we build something great, someone will buy it at an amazing multiple.”

“We’ll figure out M&A when the time is right.”

The truth is far messier. Getting acquired is as much about timing, process, relationships, and discipline as it is about your product or traction. In many ways, the harder part is front-loading the things you can control so that you’re ready when you need to be.

Just because you want to sell doesn’t mean you will be able to do so at all, let alone on a timeline you dictate. But if you plan for a sale from day one, you can put yourself in the position to sell on your terms, when you want to.

M&A is a Process, Not an Event

One of the biggest misconceptions founders have is that acquisitions involve luck. They do involve luck but counting on luck is a losing strategy. The deals you read about in TechCrunch that seem like storybook endings are really more like a Game of Thrones book where things can get very dark, very quickly.

In reality:

Most acquisition processes take 6 months to a year (sometimes more).

Companies are bought, not sold: you can’t make a company buy your company on your terms; it takes skill, planning, and process.

Deals go sideways all of the time. For so many reasons.

If you wait until you need to sell, say because your runway is ending, it will be very hard for you and you will probably fail. In spite of all those TechCrunch articles.

You want to start preparing for acquisition long before you think you'll ever sell. Here’s how.

Build for Sale from Day 1

When you’re acquired the acquirer will look at everything in detail back to the very beginning of your company. Nobody wants to buy a liability.. There are mistakes you could make before you even incorporate that kill a deal 5 or even 10 years down the road. These mistakes are avoidable. So, from Day 1, avoid them.

Incorporation, Legal Hygiene, and Cap Table Correctness

Incorporate in an investor-friendly jurisdiction (Delaware C-Corp is still the de facto standard). Keep your cap table clean and up to date, especially if you have founders, early hires, and investors.

Patchy legal documentation, misfiled equity grants, or undocumented contractor arrangements can derail a deal in due diligence. Not only does it create real legal risk for the acquirer, but also it casts a shadow on your ability as a manager. If these simple things are broken, what else was mismanaged?

Budget to have legal contracts, NDAs, employment agreements, contractor papers, etc., done right. This is easier than ever with Carta, Rippling, Deel, and other platforms. And no, ChatGPT is not your HR lawyer. Get a real attorney. Let them use ChatGPT, if they must, because they can spot the hallucinations. You probably can’t.

Financial Discipline and Modeling

As soon as you have some revenue, if not before, you should run your business like a business. That means:

A simple financial model (Revenue / Expenses / Salary)

Conservative assumptions and clear levers

Tight cash management (collect faster, negotiate payables)

Rapid adjustment when reality diverges from plan

Not only will this set you up for a better outcome later, it might also save you painful early dilution. Many founders miss an early revenue target, fail to adjust spending to compensate, and have to bridge to close the gap–which can be the most expensive capital they raise on their journey.

Partnerships and Relationships

Rarely does an acquisition offer come from a stranger out of the blue. Acquirers often come from existing relationships: partners, platform integrations, or friendly competitors. Start building them early, authentically. Be part of the conversation in your industry and you’ll find yourself with a lot of options when you need them–and even when you don’t.

The Multiple-Offer Imperative

One of the most powerful truths in negotiating an exit: you want at least three serious offers, not one.

Multiple offers give you bargaining power

They allow you to play off acquirers against each other

Even 2 offers (if they are similar) ensure you’re getting a fair price

If you enter a negotiation with only a single offer, you have minimal leverage. Of course, one offer is better than none–but three is ideal. Many more than that can become distracting, as you have to field too many diligence requests and can be spread too thin.

When time is short (i.e. your runway is low), you may not have the luxury of getting three. In that case, just get the deal closed as best you can. Invent whatever leverage you can to make sure you aren’t taken advantage of–but realize, you might be, and that’s ok.

What to Do When You’re Nearing Zero Runway

A lot of founders panic when cash gets tight—and that’s when they make mistakes. If you are down to 1-2 months, it is too late. You have to shut down. When you are 6 months out, it’s time to cut back dramatically on expenses. At this point you could buy yourself 3-6 months depending on your stage and burn rate. If you wait til you are at your last 3-4 months of runway, even a major reduction in expenses would only buy you weeks–not enough.

Sometimes this is beyond your control. A major customer doesn’t renew, or an investor backs out last minute. This is why good cash management habits are so important to build early–but that doesn’t mean disaster won’t strike. Here’s how to manage it:

Face the music early. At 3–4 months of runway, you need to act with urgency if you want to get acquired.

Cut costs to buy time. Layoffs, trimming optional spending—anything to extend the horizon.

Talk to your partners, customers, and others you have relationships with. These are your most likely short timeline acquirers because they are familiar with you and your product.

Use urgency, but don’t lie. If you're running out of money in 3 months, they will find that out in diligence. If you lie, they will walk away. If you’re honest, you might get a lower price–but the deal will close. Most corp dev people have zero tolerance for things that look and feel like fraud.

Accept tradeoffs. You may have to accept earnouts, rollover equity, or whatever terms the buyer demands.

Be willing to shut down. Shutting down could be your leverage to a bad acquisition deal.

It takes time and costs money to shut down. If you’re at that stage, get smart about startup shutdowns.

Many founders are reluctant to make cuts, thinking that the “team” is what they’re selling. In today’s market almost nobody will buy your burn rate. If you are burning $1mm a month, on say $1mm in revenue, your business will actually make the acquirer worse off financially. Cut your costs to make the acquisition palatable, and extend the time you have to find an acquirer.

The Unavoidable Trade-Offs

Even when everything lines up, exit terms always carry tradeoffs:

Structural complexity: escrow, indemnities, holdbacks, earnouts, clawbacks, retention bonuses, or roll-over equity.

The value gap: buyers pay for what they can monetize today, not for your grand vision.

Execution risk: integration challenges, cultural mismatches, retention of key team members, customer transitions.

Liquidity vs. upside: rolling equity into the acquirer can mean big gains—or nothing.

The sooner you internalize these realities, the less painful the negotiation feels.

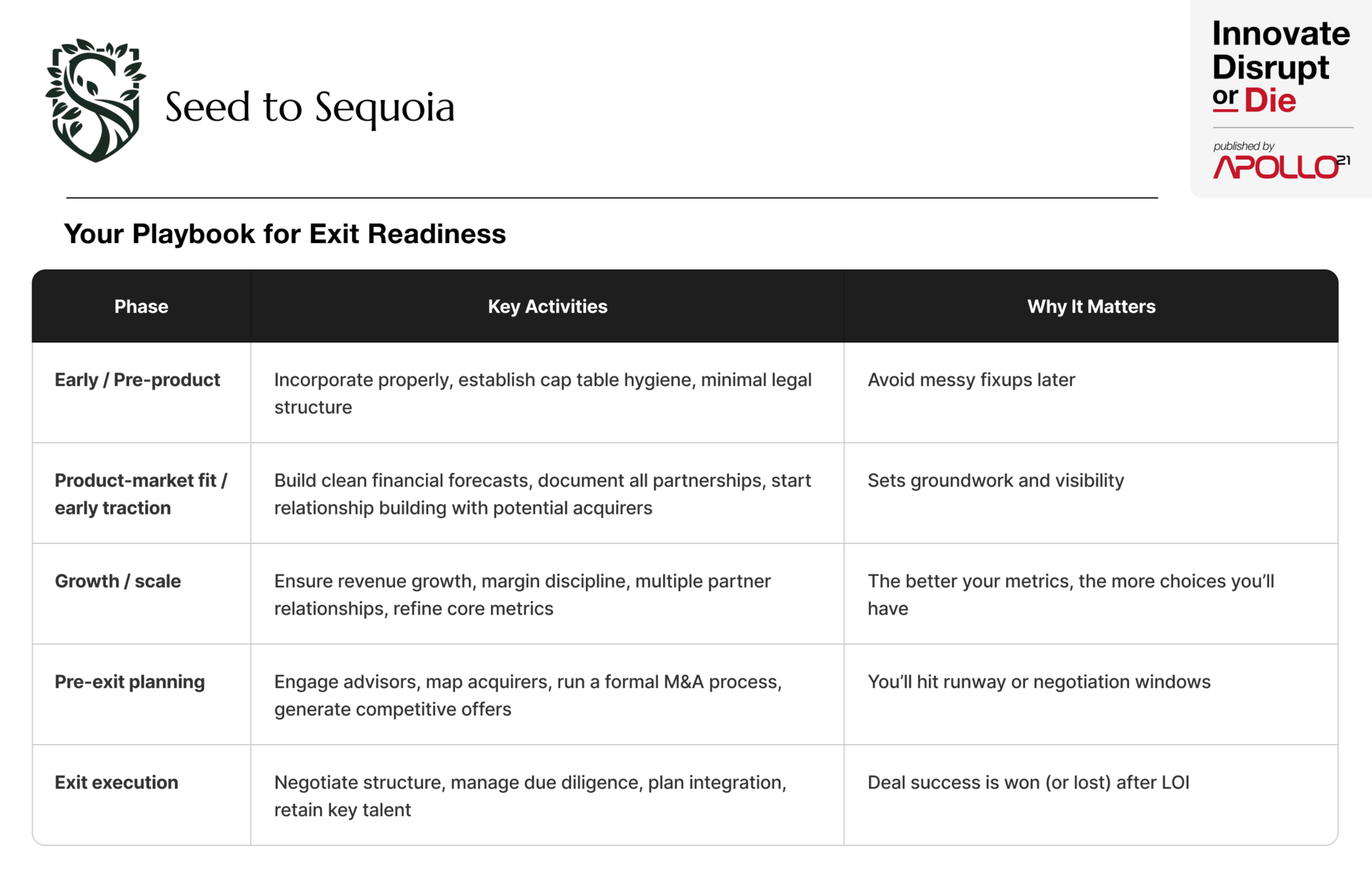

Your Playbook for Exit Readiness

Phase | Key Activities | Why It Matters |

Early / Pre-product | Incorporate properly, establish cap table hygiene, minimal legal structure | Avoid messy fixups later |

Product-market fit / early traction | Build clean financial forecasts, document all partnerships, start relationship building with potential acquirers | Sets groundwork and visibility |

Growth / scale | Ensure revenue growth, margin discipline, multiple partner relationships, refine core metrics | The better your metrics, the more choices you’ll have |

Pre-exit planning | Engage advisors, map acquirers, run a formal M&A process, generate competitive offers | You’ll hit runway or negotiation windows |

Exit execution | Negotiate structure, manage due diligence, plan integration, retain key talent | Deal success is won (or lost) after LOI |

A Few Bonus Lessons from the Field

When M&A sentiment is positive, it can be contagious. Just because you got offers now doesn’t mean you’ll get any–let alone better ones–in 9 months from now.

Sometimes the best path is to sell the company with the team or via acquihire, even if that means giving up on your original vision.

Don’t rely on your board or investors to source buyers. They might help, but they have their own incentives. Ask for help, of course, but also bring options.

Interview bankers or advisors. These meetings are free and you’ll learn a lot.

If you can, use an advisor if you’ve never done this before. The stakes are too high to learn this on the job. Even if you are sub-$1mm ARR, business brokers may be able to help you get a deal done (for a substantial fee).

Always have a fallback: whether that’s raising a small bridge, scaling down to profitable operations, or shutting down.

Final Thoughts

Exits are rarely magical. They are built, piece by piece, over time. The founders who walk away with the best outcomes are the ones who treat acquisition readiness as part of the core playbook, not as a someday side quest.

Share This

Remember: you can innovate, disrupt, or die! ☠️

Have you seen our free resources?

Apply to be a podcast guest!

Know an innovator who needs this?

Was this email forwarded to you?