What You’ll Find This Week

HELLO {{ FNAME | INNOVATOR }}!

Innovation is (and has been for decades) a hot-button topic in the world of business. Throw that word on the table and you’re likely to incite anything from a healthy debate to an all-out riot. Everyone has their own perspective on what an org can or should do when it comes to “innovation.” And those (mostly healthy) debates are made even more inflammatory by the fact that if you ask 10 people what “innovation” means to them…you’ll get 12 different answers.

The reality is we’re all fighting the good fight. And regardless of which you think is more fun to execute, the various forms and focal points of innovation have different use cases depending on the needs. This week, I break down how to align your innovation levers to the metrics that you are aiming to move.

Here’s what you’ll find:

This Week’s Article: People Love Arguing About Innovation

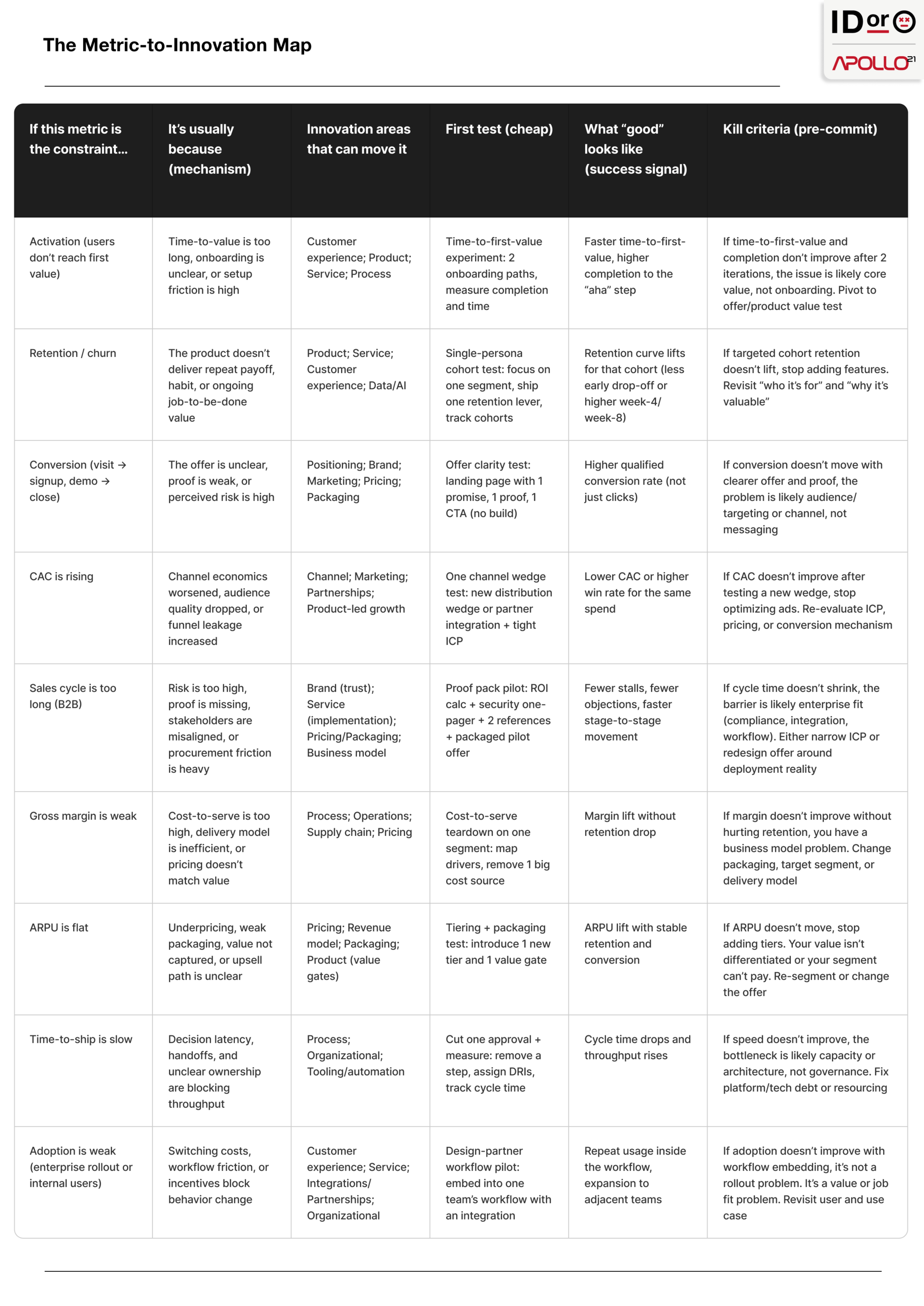

Share This: The Metric-to-Innovation Map

Don’t Miss Our Latest Podcast

This Week’s Article

People Love Arguing About Innovation

Brand innovation. Product innovation. Business model innovation. Corporate innovation. And that debate usually goes nowhere.

Stop picking a “type of innovation” first. Start with the bottleneck.

What number is actually stopping you right now?

Innovation “areas” are just levers. Each lever moves certain numbers. You shouldn’t be choosing the type of innovation because it’s fun, but rather because it has the capacity to change the metric you need changed.

When teams blow this, it’s not because they “don’t measure.” It’s because they grab a metric that’s easy to defend, then they pull the wrong lever as hard as they can. Lots of motion. Lots of effort. Zero impact.

The Certainty-Proxy Paradox

The more certainty the system demands, the more it forces teams to hide behind proxies. That’s how you get beautiful dashboards and zero movement on the constraint.

The Certainty-Proxy Paradox

Funding demands certainty. Someone asks for a forecast.

Certainty demands a metric. Something needs to be “measurable.”

Teams pick the safest metric, not the right one. A proxy that is easy to defend wins.

Then they optimize it like their job depends on it. Because it does.

Anything cross-functional gets stuck. Pricing, channel, partnerships, business model. All need approvals.

Approvals create decision latency. Work slows down.

Slowness increases the demand for certainty. And the paradox gets worse.

This is how smart teams end up maniacally improving a metric that doesn’t map to the real need or constraint.

The Escape Hatch

Here’s how you get out of the paradox without pretending you can predict the future…

Start with the metric that is truly constrained. Not the one that looks good on a dashboard. The one that, if it moved, would change the business.

Then name the mechanism. In plain language. What is causing that number to stall?

Only then do you pick an innovation area. Not because it’s your team’s favorite lane, but because it is the lever that can change the mechanism.

Now make it real with a test. The smallest move that could prove you right or prove you wrong.

And before you start, write the kill criteria. What would make you stop, pivot, or narrow the bet.

If you can’t name the metric, the mechanism, the lever, the test, and the kill criteria, you’re not ready to “do” innovation. You’re simply playing defense amongst the office political animals.

Innovation Areas Only Matter Because of What They Change

You can keep debating “types of innovation” forever. The only useful reason to name them is to choose the right lever for the constraint.

Product Innovation

Product innovation changes what the user can do and what the product can reliably deliver.

Related metrics: activation, retention, willingness to pay.

Customer Experience Innovation

Customer experience innovation changes how quickly and how safely someone reaches value, from first touch through ongoing use.

Related metrics: activation, conversion, retention.

Service Innovation

Service innovation changes onboarding, implementation, support, and success. It is how you deliver outcomes when the product alone is not enough.

Related metrics: retention, sales cycle, expansion.

Pricing and Packaging Innovation

Pricing and packaging innovation changes how you capture value, what gets included, and what customers can say yes to.

Related metrics: ARPU, conversion, gross margin.

Brand and Positioning Innovation

Brand and positioning innovation changes what the market believes you are, who you are for, and how risky you feel to bet on.

Related metrics: conversion, sales velocity, win rate.

Channel and Partnership Innovation

Channel and partnership innovation changes how you reach customers and how distribution compounds.

Related metrics: CAC, pipeline quality, growth rate.

Business Model Innovation

Business model innovation changes who you serve, what you deliver, and how the money works end to end.

Related metrics: unit economics, payback period, LTV to CAC.

Process and Operational Innovation

Process and operational innovation changes how work gets done and how delivery scales, including cost-to-serve.

Related metrics: gross margin, cycle time, reliability.

Organizational Innovation

Organizational innovation changes decision rights, incentives, and the speed at which cross-functional work can happen.

Related metrics: time-to-ship, throughput, cycle time.

If your constraint is CAC, product innovation is rarely your first move. If your constraint is margin, brand work is rarely your first move. The lever needs to match the mechanism.

The Metric-to-Innovation Map

The 10-Minute Triage

When the team is thrashing, this is the reset.

Pick one metric that would change the business this quarter. One. Then force a real explanation for why it is stuck by naming the mechanism in plain language. If you cannot say “because” without reaching for buzzwords, you are not ready to choose an innovation focus.

Once the mechanism is clear, choose the innovation area that can actually change it. Then define a small test you can run quickly, not a program you can defend for months. Finally, write the kill criteria before you start. If you cannot agree on what would make you stop, you are about to pay for certainty with proxies.

That is controlled learning. It is how you move the constraint without pretending you can forecast it.

Which Innovation Area Should You Focus On, When?

The answer depends on your stage. Your stage changes which metric is the constraint.

Zero-to-One: Prove Value

Your constraint is almost always one of these: activation, retention, willingness to pay.

For startups, this stage is forced on you. The market will not let you skip it.

For corporate ventures, this stage is easy to fake your way out of. The organization will try to drag you into later-stage questions early: forecasts, business cases, efficiency, governance. Treat that as noise. If you have not proven value, your job is not to be predictable. Your job is to learn.

Focus on:

Product innovation

Customer experience innovation

Pricing and packaging innovation

Positioning and brand proof

Go-to-Market: Prove Distribution

Your constraint usually moves to CAC, conversion, and sales cycle.

Startups usually fail here by thrashing. New channel every week. Same offer. Same conversion. Same CAC.

Corporate ventures fail here by staying “safe.” They avoid levers that touch pricing, channel, and partnerships because those require permission. So they keep pulling product levers and wonder why distribution does not improve.

Focus on:

Channel innovation

Partnerships and ecosystem innovation

Brand and positioning (trust)

Service innovation (implementation and success)

Scale: Prove Efficiency

Your constraint moves to margin, reliability, and time-to-ship. This is where efficiency becomes strategy.

Startups usually arrive here late. They have to earn the right to care about process.

Corporate ventures often arrive here early. Not because the venture has scale, but because the parent organization demands scale behavior. If you optimize efficiency before you have a repeatable growth engine, you will get better at shipping the wrong thing.

Focus on:

Process and operational innovation

Supply chain or delivery model innovation (where relevant)

Organizational innovation (decision rights, incentives, autonomy)

Pattern: Sell the Dream as a Test

Most teams try to buy certainty with spreadsheets. A faster move is to buy learning with real commitments.

If your constraint is early adoption or sales velocity, you do not need a perfect product to learn. You need proof that the market will move. Brand, positioning, and packaging can create that proof, as long as you treat it like a test.

The rule is simple. Do not “sell the dream” to hype. Sell it to measure.

Define the promise.

Define the proof you will show.

Define the commitment you want.

Define the kill criteria if the market does not bite.

If you want the deeper version of this pattern, here’s the IDOD breakdown:

The Only Rule That Matters

If you remember one thing, remember this: the business doesn’t care how innovative your work looks. It cares if the constraint moves.

That’s why the “types of innovation” debate is a trap. It lets you choose work by preference instead of by need.

Here’s the filter: metric, mechanism, lever, test, kill criteria. If any of those are missing, you don’t have a priority. You have a story.

Pick one constraint this week and run one test that could embarrass you. If you’re not willing to be wrong quickly, you’ll be wrong slowly.

Share This